Introduction

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They allow investors to get professional money management across a range of strategies and investment options. Mutual funds charge annual fees, expense ratios, or commissions, which may affect their overall returns.

A systematic investment plan (SIP) is an investment vehicle offered by many mutual funds, allowing investors to invest small amounts periodically instead of lump sums. The frequency of investment is typically monthly, quarterly, semi-annually, or annually. In SIPs, a fixed amount of money is debited from the investors’ bank accounts periodically and invested in a mutual fund, with the investor being allocated units according to the current Net Asset Value (NAV).

Fixed Deposits (FD) and Recurring Deposits (RD) are savings schemes offered by banks and financial institutions. FD is a low-risk and safe form of investment, while RD is a savings scheme requiring monthly payments. The returns on both RD and FD are taxable, making these investments suitable for investors in lower tax brackets. The interest rates on FD and RD vary from 5% to 9%, with special rates applicable for senior citizens. On the other hand, SIP offers moderate to high risk, and the returns depend on the stock market or debt instruments. SIP is good for investors who have long-term goals and long-term investment plan, providing a better investment avenue for investors looking for tax exemptions with products.

Top SIP Investment Plans in 2024

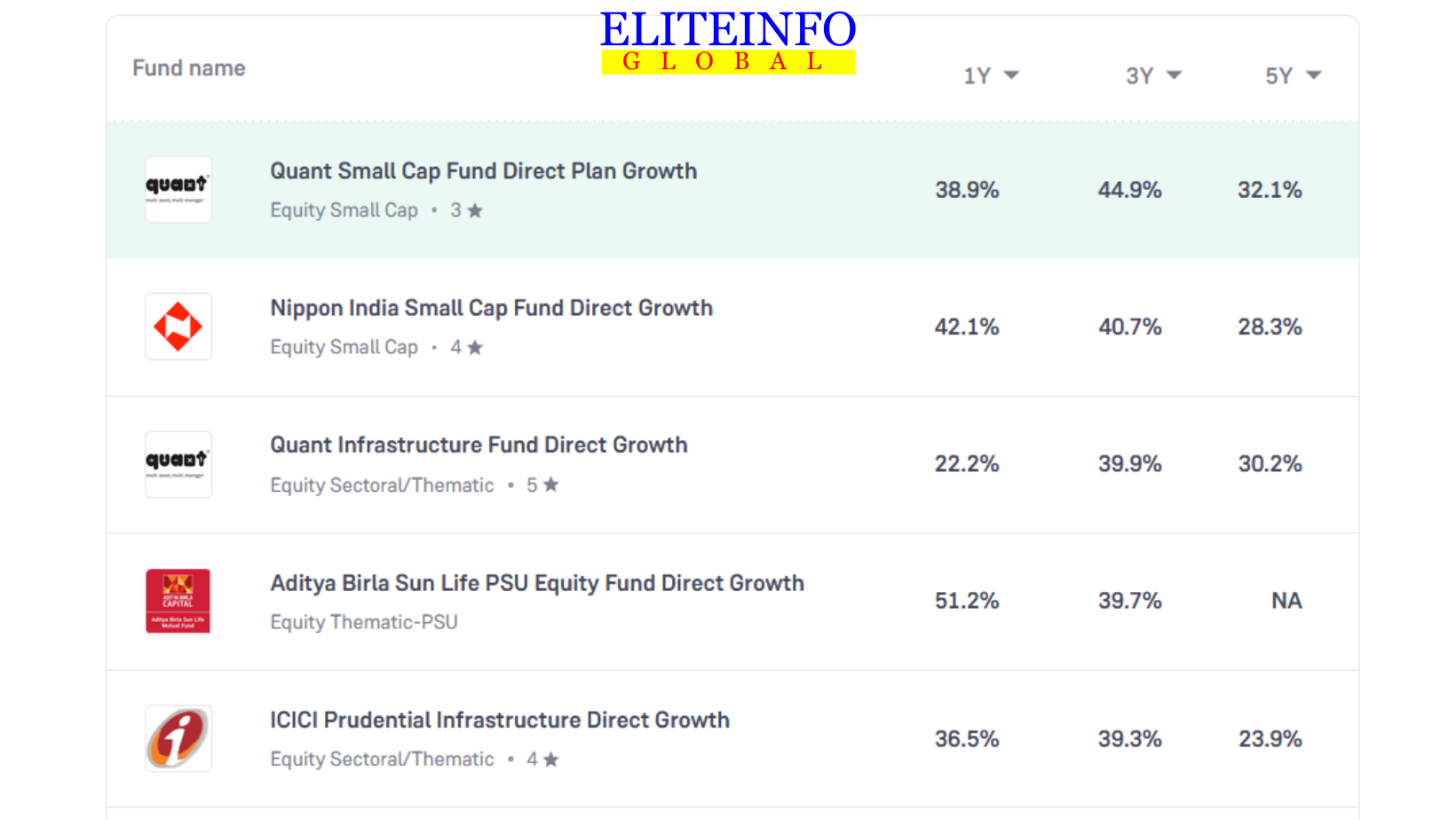

Top Mutual Funds with High Returns in the last 3-5 years (as on December 2023)

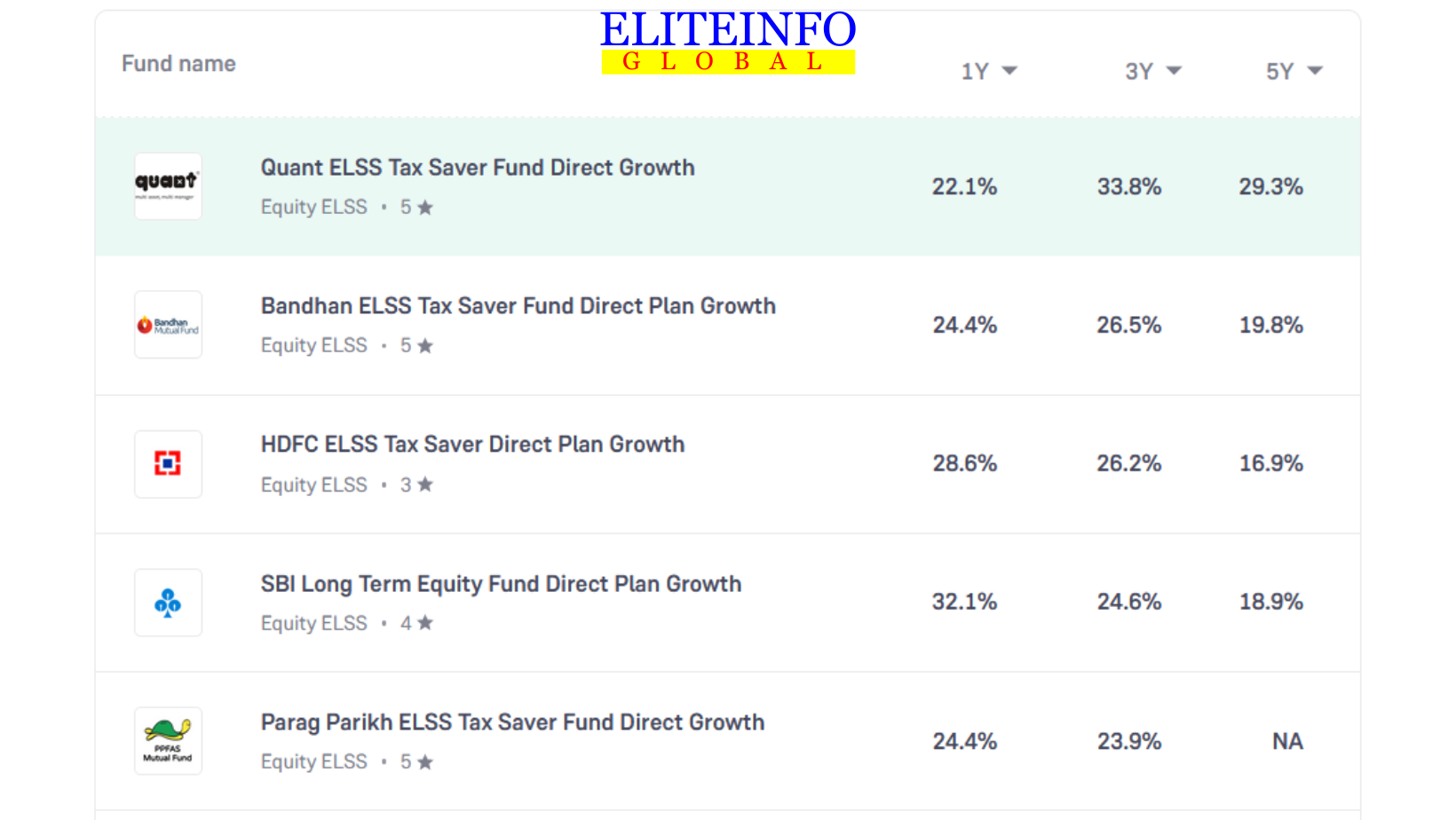

Tax Saving Mutual Funds while building wealth (as on December 2023)

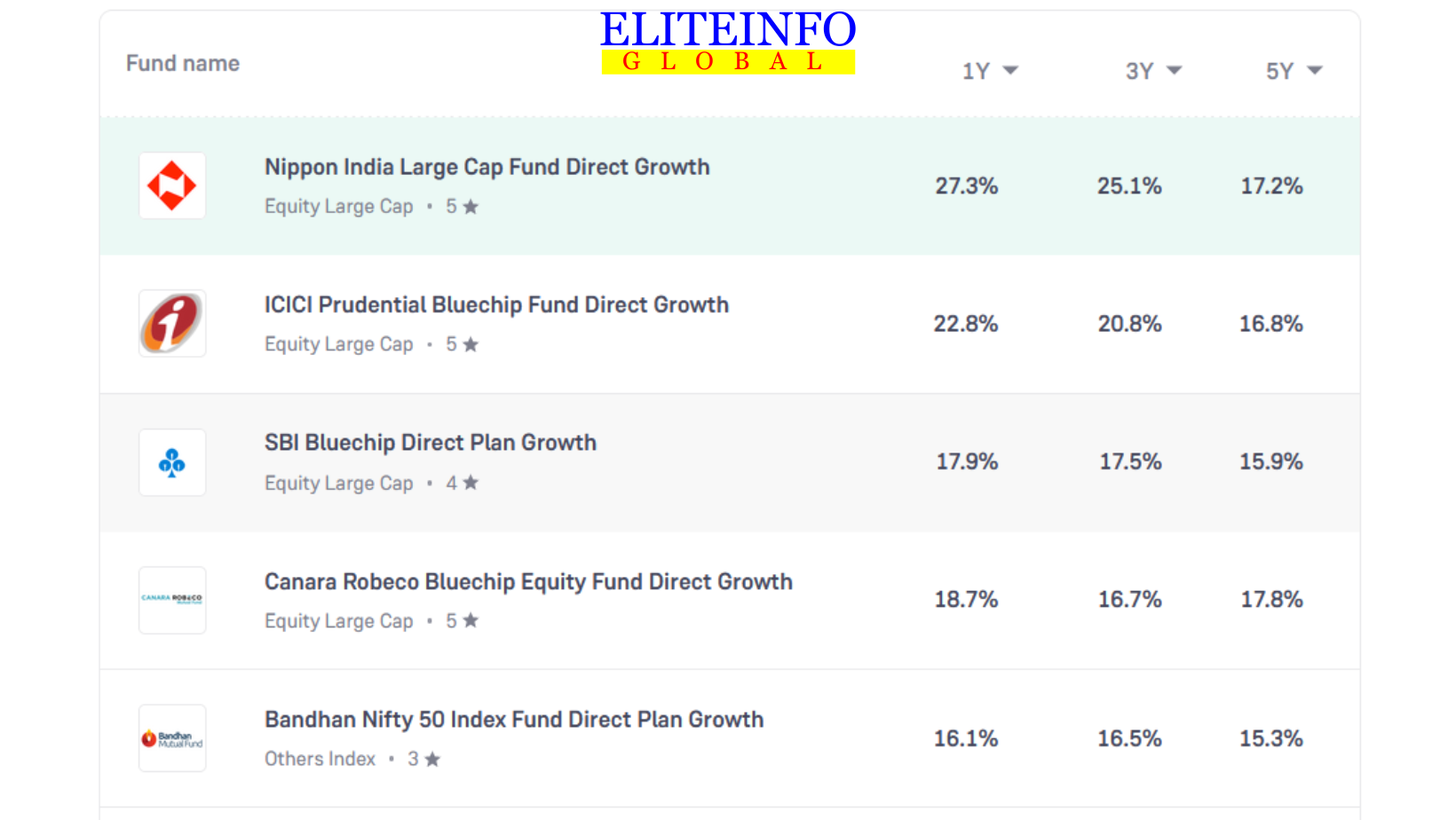

Large Cap Mutual Funds (as on December 2023)

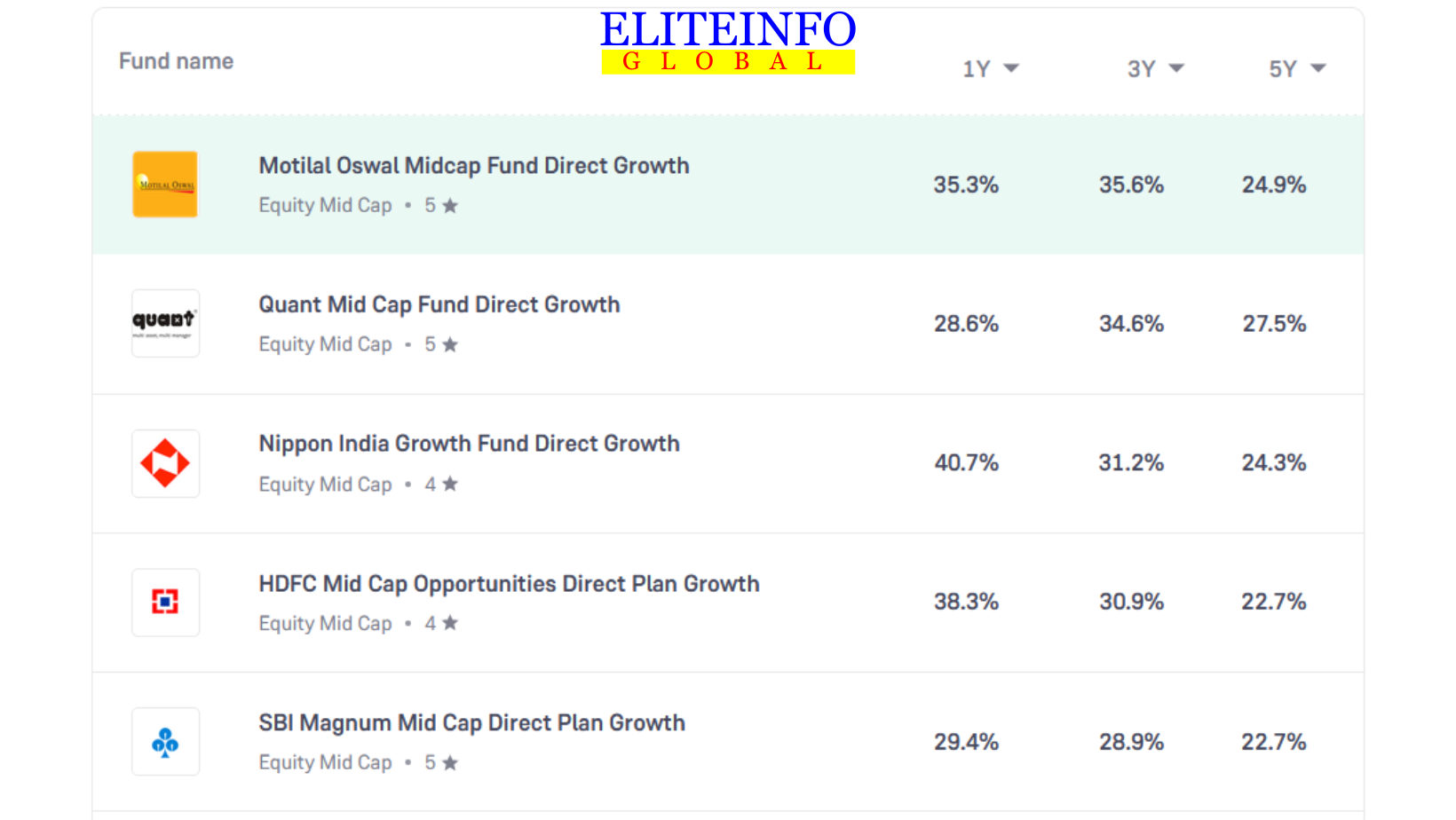

Mid Cap Mutual Funds (as on December 2023)

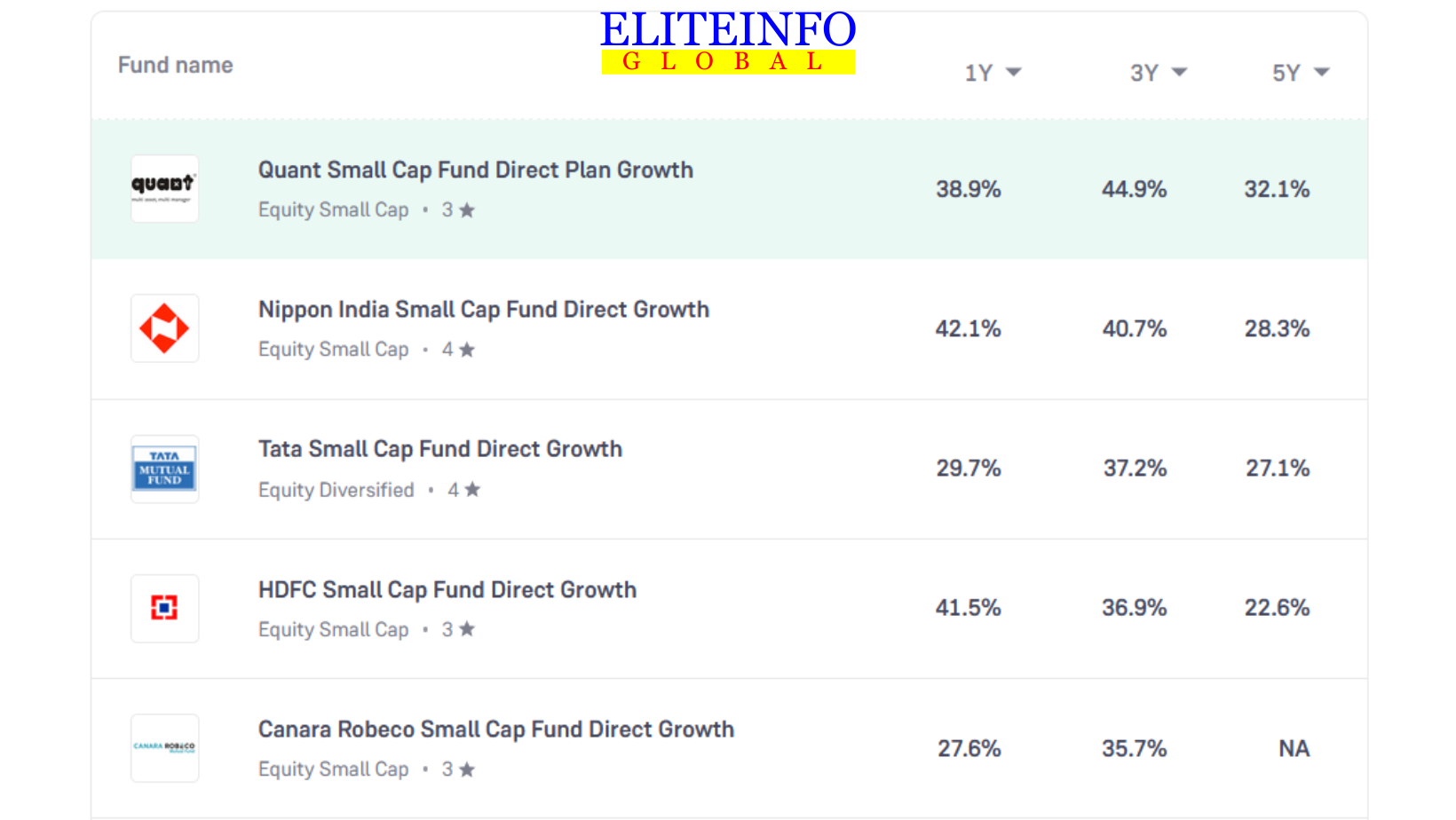

Small Cap Mutual Funds (as on December 2023)

Factors to Consider While Investing in SIP

Before investing, consider factors like investment objectives, risk tolerance, investment horizon, fund manager’s track record, expense ratio, diversification, liquidity, and past performance.

When considering investing in a Systematic Investment Plan (SIP) in 2024, there are several factors to take into account. These include your investment goals, risk tolerance, the fund’s past performance, expense ratio, and investment objective. Additionally, it’s important to choose the best scheme to help you achieve your objectives, whether they are long-term or short-term. Furthermore, it’s essential to understand the power of compounding and rupee cost averaging, which are fundamental principles in SIP calculations. Finally, it’s advisable to invest as early as possible to maximize wealth over time, and SIPs are considered a safe and secure way to invest in securities, suitable for both experienced and first-time investors.

Step 1: Define Your Goal

Before initiating your investment in an SIP, it’s crucial to define your financial goals. Whether it’s funding education, buying a home, securing your retirement, or acquiring a significant asset like a car, having a clear goal in mind will guide your investment strategy. Understanding your goals will help you choose an investment plan that aligns with your specific needs and time horizon.

Step 2: Determine The Value Of Investment Required

Once you’ve identified your goals, estimate the amount of money required to achieve them. Assign a current cost to the objective. Additionally, determine the future cost of the commodity in the year you plan to acquire it. These values will assist you in calculating the instalment amount you need to invest regularly to reach your financial goals.

Step 3: Prepare A Finance Schedule

To align your investment with your goals, establish a finance schedule. Identify whether you’ll need the invested money in the short term (2 years), mid-term (5 years), or long term (10 years). This classification will help you select a suitable mutual fund investment duration that matches your specific financial objectives.

Step 4: Identify The Investments

Choosing the right asset class is crucial for achieving your goals within the planned timeframe. Consider the risk factor associated with different schemes—higher returns often come with higher risks. For short-term goals, liquid funds may be appropriate due to their low-risk nature. Evaluate various options based on your risk tolerance and return expectations.

Step 5: Choose The Right Scheme

Selecting the right mutual fund scheme is a critical step in your investment journey. Conduct thorough research on available schemes or seek guidance from asset management companies or fund houses. Depending on your financial goals and investment duration, experts can help you determine the most suitable mutual fund scheme that aligns with your aspirations.

Step 6: Monitor Regularly

Investing doesn’t end with selecting the right scheme; regular monitoring is key to ensuring your investment stays on track. For short-term investments, maintaining a close watch on your scheme’s performance is essential. For long-term investments, periodic reviews help you stay informed about your scheme’s progress, making any necessary adjustments based on market conditions.

Advantages of SIP Plans in 2024

Systematic Investment Plans (SIPs) are a popular investment option in 2024, offering several advantages to investors. Here are some of the key benefits of investing in SIPs:

- Disciplined approach: SIPs encourage a disciplined approach to investing, helping investors maintain a consistent investment pattern regardless of market conditions

- Rupee Cost Averaging: SIPs allow investors to buy more units when the market is low and fewer units when the market is high, reducing the cost of investment and potentially providing higher returns over time

- Flexibility: SIPs offer flexibility in terms of investment amount, frequency, and duration, allowing investors to customize their investments as per their financial goals and risk tolerance

- Long-term wealth creation: SIPs are a long-term investment option, providing the potential for significant wealth creation over time

- Diversification: SIPs allow investors to diversify their portfolio by investing in multiple funds or schemes, spreading their investments across different asset classes and risk profiles

- Lower investment amount: SIPs allow investors to start investing with a lower amount, making it accessible to a wider range of investors

- Compounding benefits: SIPs offer the benefit of compounding, where the returns earned on the investment are reinvested, leading to higher returns over time

While SIPs offer several advantages, it’s important to note that they are subject to market fluctuations and returns are not guaranteed. Additionally, investors should carefully assess their risk tolerance and financial goals before investing in SIPs. Overall, SIPs are a simple and effective way to invest in mutual funds, providing a disciplined and flexible approach to long-term wealth creation

Keep in mind before selecting any Mutual Fund

- Choosing the right SIP plan in 2024: Consider factors like investment goals, risk appetite, investment horizon, and fund performance.

- Factors for selecting an SIP: Past performance, expense ratio, investment objective, asset allocation, and fund manager’s experience.

- SIP performance from 2022 to 2024: Performance may vary based on market factors; regular review is recommended.

- Tax implications of SIPs in India in 2024: Tax implications include capital gains tax, dividend distribution tax, and securities transaction tax. Consult a tax professional for accurate information.

- SIP returns compared with other avenues in 2024: SIPs have the potential for higher returns compared to fixed deposits and savings accounts.

- New SIPs launched in 2024: Stay updated with market trends and consult a financial advisor for information on new investment opportunities.

- Beginners starting SIPs in 2024: Understand goals, risk appetite, and research different SIP plans for a suitable choice.

- Difference between SIPs in mutual funds and direct stocks: SIPs in mutual funds offer diversification managed by professionals, while direct stocks require more research.

- Tracking SIP investments’ performance: Regularly review your portfolio, compare it with benchmarks, and use online tools provided by mutual fund companies.

- Safety of investing in SIPs during volatile market conditions: Diversify your portfolio and maintain a long-term investment horizon to mitigate risks.

Risks associated with SIP investments

Investing in Systematic Investment Plans (SIPs) in 2024 carries certain risks that investors should be aware of. Some of the key risks associated with SIP investments include:

- Market Risk: SIPs are subject to market risk, especially when investing in equity mutual funds. The value of investments can fluctuate due to market conditions, potentially resulting in losses

- Volatility: Short-term market volatility can impact the performance of SIP investments, particularly in equity mutual funds. In a one-year period, the risk of losses due to market downturns may be higher

- Return Expectations: The potential returns from a short-term SIP, such as one year, might be limited, and the investment may not have sufficient time to realize its full potential

- Liquidity Needs: The suitability of a short-term SIP depends on the investor’s liquidity needs. If there are specific short-term financial goals, a short-term SIP might align with those goals

It’s important for investors to carefully assess their risk tolerance, investment goals, and time horizon before opting for SIP investments. While SIPs offer benefits such as rupee cost averaging and long-term wealth creation, it’s essential to consider the associated risks and the potential impact of market fluctuations on the investment.

Conclusion

In conclusion, SIPs remain an efficient and successful means of long-term investment. They offer a disciplined approach, ease of handling, and potential for higher returns. Choosing the best SIP in 2024 requires a thorough understanding of one’s financial goals, risk tolerance, and investment horizon. Seeking advice from financial professionals is recommended for personalized guidance.