Introduction

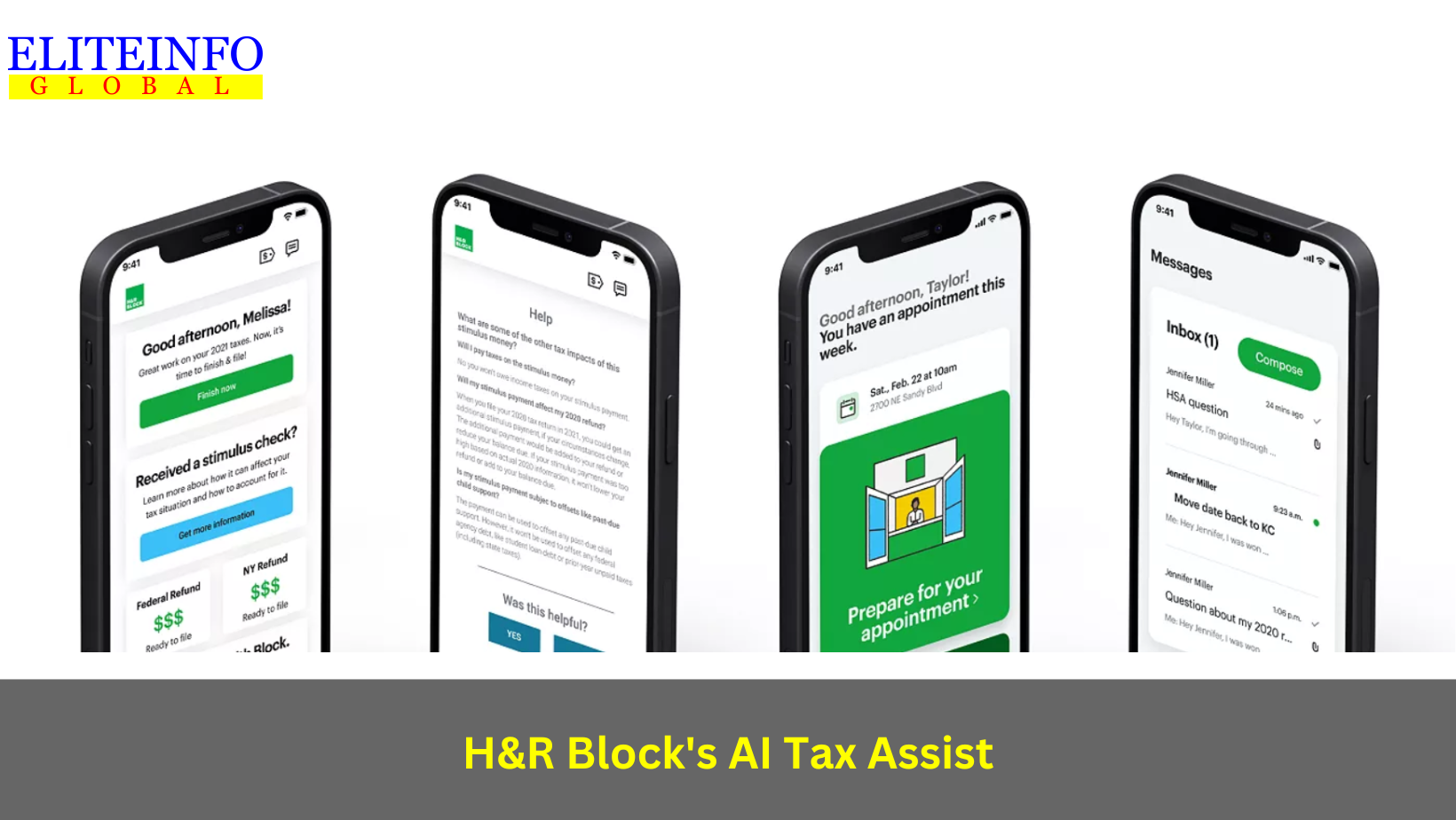

Tax season is notorious for being a stressful period, with many individuals seeking guidance on the details of tax rules & regulations with potential exemptions. To overcome the burden, H&R Block, a leading tax preparation company, has launched a new tool to simplify the process—AI Tax Assist, a conversational AI chatbot integrated into its DIY tax software.

The world of artificial intelligence (AI) chatbots has broad knowledge ranging from assisting with boring tasks like writing a thank-you note to more complex tasks like crafting cover letters. However, trusting chatbots is still risky in financial matters including personal finance and tax-related queries. The introduction of a virtual tax expert by H&R Block’s AI Tax Assist can solve this matter by offering a dedicated tool tailored for addressing tax questions. Combining almost 70 years of trusted tax expertise with cutting-edge AI technology from Microsoft Azure OpenAI, this innovative solution aims to simplify and streamline the tax preparation process for individuals, self-employed professionals, and small business owners.

In a world that is increasingly reliant on technology and artificial intelligence, H&R Block has taken a skillfull initiative in tax preparation with the introduction AI Tax Assist. This blog explores the unique features of H&R Block’s AI Tax Assist, how it differs from general-purpose chatbots, and the potential it holds in simplifying the task of tax preparation.

The Power of AI Tax Assist

H&R Block AI Tax Assist is not just another AI tool; it’s a comprehensive generative artificial intelligence experience designed to empower users to file and manage their taxes confidently.

Key Features:

- Tax Information: It provides instant information on tax forms, deductions, and credits, ensuring that users can maximize their potential refunds and minimize tax liability. Users can access reliable information by searching without depending on the communities or browsing it in the search engine which may provide incorrect or misleading data.

- Tax Preparation: The AI Tax Assist guides the users through tax preparation process by asking questions, answering tax theory queries, and providing navigation instructions when needed. This real-time assistance ensures users can file their taxes confidently as many different questions are asked throughout the process.

- Tax Knowledge: Users can ask free-form tax-related questions, receiving dynamic responses that clarify tax terms and offer guidance on specific tax rules or general information about the U.S. and state tax system. This conversational approach enhances the user experience, making the tax preparation journey more intuitive and accessible.

- Tax Changes: AI Tax Assist stays up-to-date with changes in the tax code, answering questions about recently amended laws and tax policies.

Understanding the Features

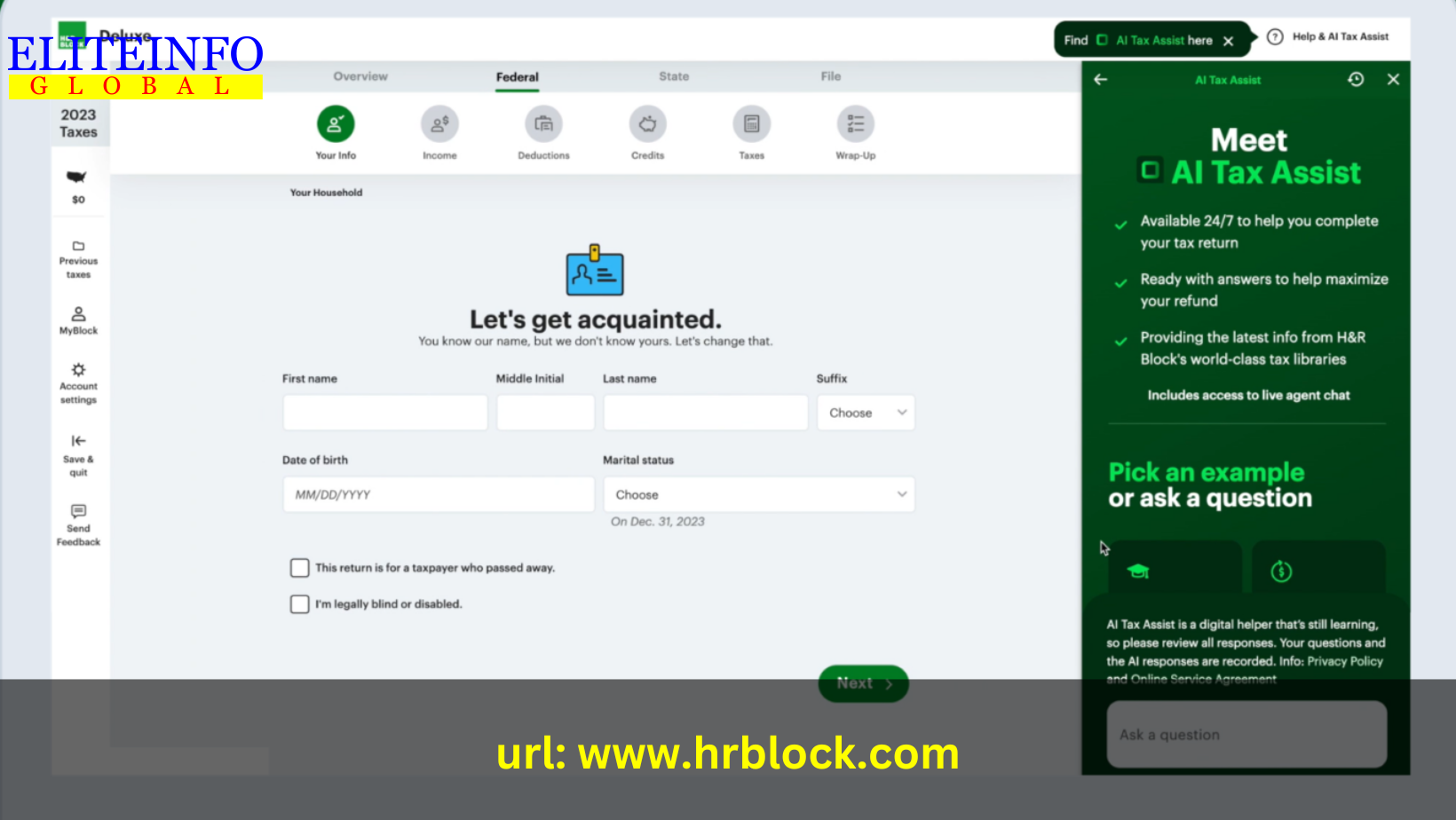

Accessible through paid versions of H&R Block’s tax software, AI Tax Assist allows users to pose questions related to tax rules, potential exemptions, and other tax-related matters. Unlike traditional tax software, this innovative chatbot not only provides information but also guides users through the complex landscape of tax filings.

For users with unique tax situations like gig workers, the chatbot gives required and important information only. Demonstrate users initiating their tax returns and asking specific questions, like, “What can I deduct as business expenses as an Rented Cab driver?” AI Tax Assist responds with a list of allowable deductions, informing user to decide whether to include them in their final filing or not.

Integration with Human Expertise

One distinguishing feature of H&R Block’s AI Tax Assist is its integration with human expertise. While the chatbot can provide valuable information on common tax questions. It also recognizes the complexity of individual financial situations. In situations where personalized advice is required, the chatbot directs users to a human tax expert. This dual approach aims to strike a balance between the efficiency of AI-driven solutions and the understanding that human experts brings to different financial scenarios.

User-Friendly Design and Real Conversations

H&R Block’s AI Tax Assist is designed to facilitate natural conversations, eliminating the need for users to rely on specific keywords. This user-friendly interface allows individuals to ask questions in a conversational manner, making the interaction with the chatbot more intuitive and accessible. The tool covers a wide range of topics, including explanations of tax forms, eligibility for credits and deductions, estimated payment requirements, and clarification of tax terminology.

Partnership with Microsoft’s Azure OpenAI Technology

H&R Block AI Tax Assist is powered by Microsoft’s Azure OpenAI Service, positioning it as a leader in the tax industry. H&R Block is the sole company in this sector selected by Microsoft to be part of its exclusive AI 100, showcasing a commitment to prioritizing the development and deployment of solutions using Azure OpenAI service. The collaboration combines Microsoft’s state-of-the-art AI models with H&R Block’s trusted reputation and the expertise of its tax professionals, giving AI Tax Assist a significant technology.

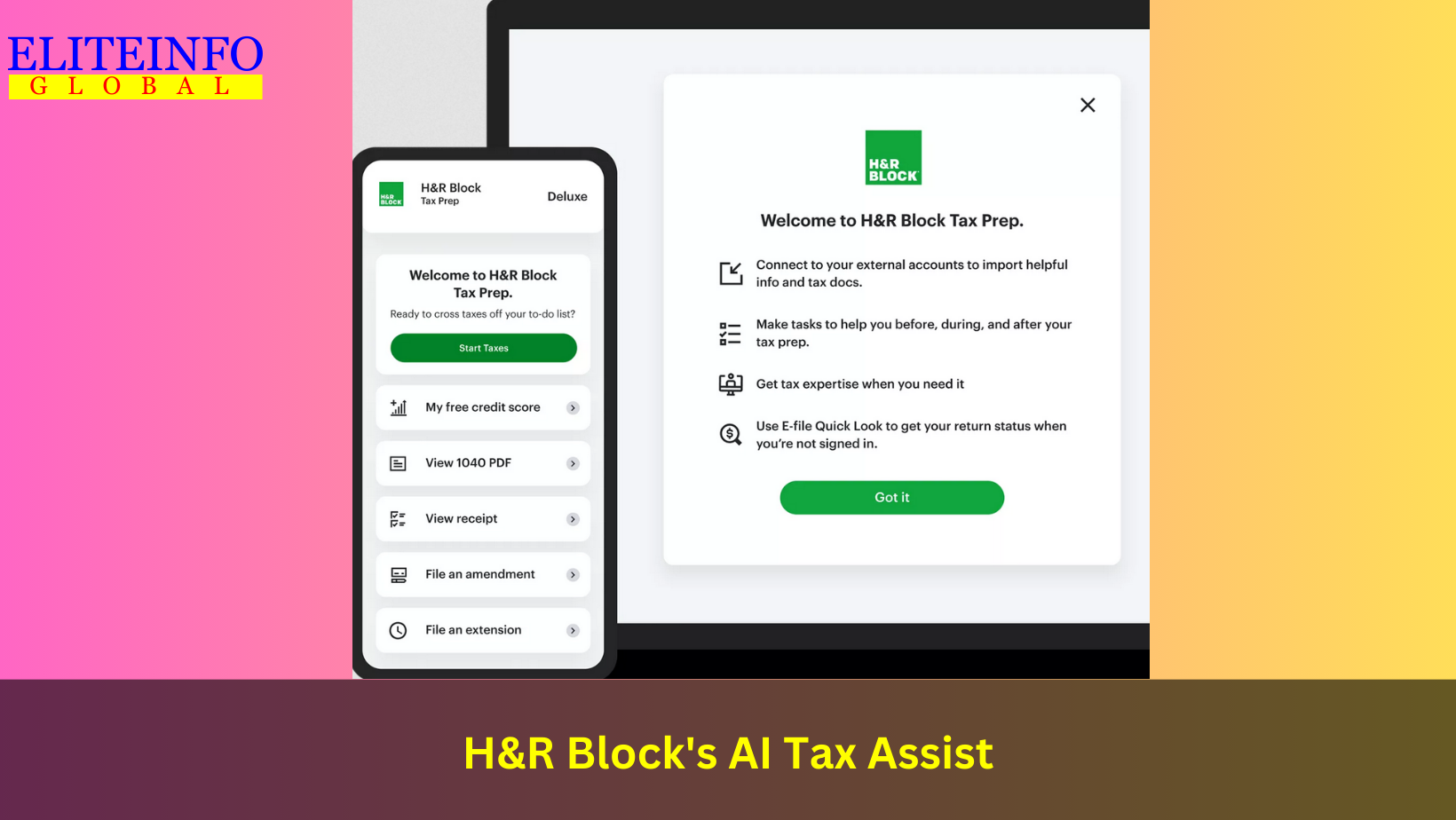

Affordability and Accessibility

This AI Tax Assist is available through subscription modules without any additional costs. Alongwith the realtime chatbot, H&R Block maintains pricing transparency with the paid plans starting at $35. This is the commitment to affordability aligns with the company’s goal of providing effective tax solutions to individuals across different financial backgrounds.

H&R Block recognizes that every tax situation is unique, offering a range of online editions to cater to different needs

- Free Online Edition: For individuals with simple tax situations, claiming unemployment income, earned income credits, or education credits.

- Deluxe Online Edition: Ideal for those with itemized deductions, homeowners, and those with slightly more complex tax situations.

- Premium Online Edition: Expertly built to handle more complex tax situations, including cryptocurrency, stock sales, and rental property income.

- Self-Employed Online Edition: Suitable for self-employed individuals, gig workers, freelancers, and independent contractors, providing support for tracking and deducting business expenses and calculating self-employment taxes.

Conclusion

H&R Block AI Tax Assist marks a significant advancement in the world of DIY tax preparation. By combining AI capabilities with human expertise, the company aims to provide users with a seamless and informative experience. As tax season approaches, this innovative tool has the potential to so show how individuals, approach and navigate the complex world of tax filings. By addressing the limitations of general AI models and prioritizing accuracy through targeted training, H&R Block has created a tool that complements human expertise rather than replacing it. The chatbot’s user-friendly design, natural conversational interface, and integration with human experts make it a valuable addition to the ocean of tools available for tax preparation. With no extra fees or upgrades required for live tax professional support, H&R Block is setting a new standard for accessible, reliable, and efficient tax filing. As the world continues to use AI solutions, H&R Block remains at the forefront, ensuring that individuals and businesses can navigate the complex world of taxes without any hesitation.